FINANCIAL PLANNING SERIES – Part 4

- 4-minute read

In the previous article of this series, we explained how you can set your financial or investment goal. Once you’re clear about your goal, the next step would be assessing your financial situation to achieve your financial goal.

Assessing your financial situation is always a good idea especially if you’re planning to get your hands on some business or investment ventures. Doing this will help you determine whether you are liquid enough and if you have that spare cash to spend. This is where you will need to reconcile your expenses with your income. This is, also, where you determine whether you have assets that can bring profit in the future, other sources of income, and the liabilities that you incur along with these assets and businesses. By doing so, you’ll have a clearer view of where you can save more on expenses, and whether you can pay off the debt load you incurred while you acquire your assets and other investments or businesses.

To know whether you financial situation is in the pink of health or not, you can take this quiz from Rutgers’ New Jersey Agricultural Experiment Stations (NJAES).

If you score 60 points or below, it’s high time you consider putting your finances in order. You can easily follow the steps below to kickstart your financial assessment.

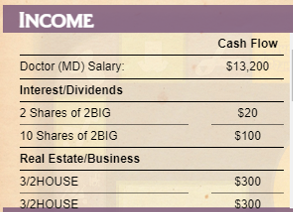

- First, add up your sources of income – to be specific, take note of how much you bring home once taxes and other deductions are taken out.

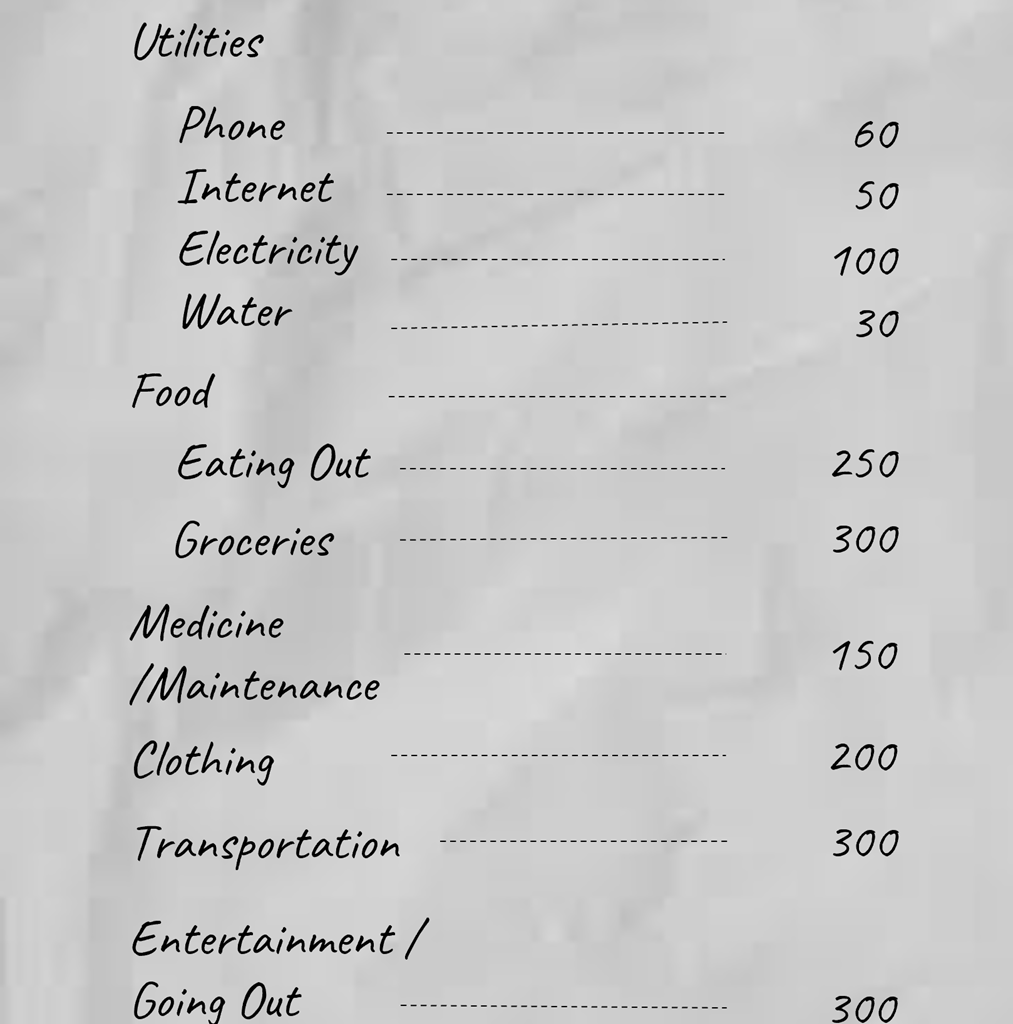

- The next step would be to make a list of your expenses. List down your monthly expenditures. You can divide this into those that you pay for monthly that have fixed cost such as your utilities and rent; and those regular items whose cost will likely change from month to month such as food, clothing, entertainment, and etc.

Then list down the other activities or items that you would likely spend on within the month such as scheduled movie night, materials for a new hobby, and so on.

- Deduct your expenses from your income. As much as possible, try to fit in your expenses within your salary if that’s your primary source of income. Secondary sources of income or passive income should, ideally, be for the purpose of building your wealth portfolio. Nonetheless, your total sources of income should be more than your expenses.

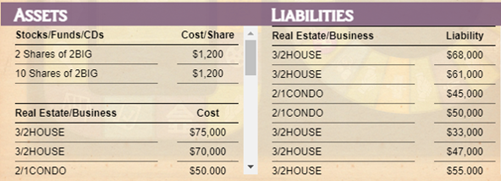

- List down your assets and/or businesses and the corresponding liabilities you incurred while acquiring these assets and/or business. If your assets and/or business are earning, add the monthly profits, dividends or interests you get to your monthly income. As for the liabilities, make sure to add the corresponding monthly mortgages or loans you’re paying to your expenses.

If you know the board game CA$HFLOW, you’ll be familiar with the Income Statement sheet that you fill out at the start of the game and during the game. As you play along, you’ll also need to update your financial statement from time to time – you may need to get a loan to buy a property, sell your stocks, add to your expenses like having a child or buying a car, give loans to your relatives, and etc. The goal is for your passive income to exceed your expenses, so you’ll be out of the rat race and be able to achieve your dream.

You can easily get such a financial statement online. You can also follow the format of CA$HFLOW’s Financial Statement. Having such a tool can help you easily track your expenses, income, and assets. With this, you’ll know how much money you can dispose of for expenses or investment. And should you need a loan, you’ll easily know how much cash will remain in your pocket after paying off your monthly loan payments.

In the fifth part of our Financial Planning Series, we will further discuss your income and expenses, and how you can set up your budget plan based on this. You may check the article here.

You can check the third part of our Financial Planning Series, “Goal Setting”, here.

You can also watch our Financial Planning Series videos here.

Thanks for sharing!